Total = $ 1,200,000 Earnings Per Share for December 2014 The company share capital structure are as follow: Income tax for the years amount $2,000,000.

#How to calculate earnings per share how to#

How to calculate earning per share?įor the period ended 31 December 2014, company A has made a profit before tax of $9,000,000. Therefore, to make sure the Earning Per Share is fairly calculated, we should use the weighted average.

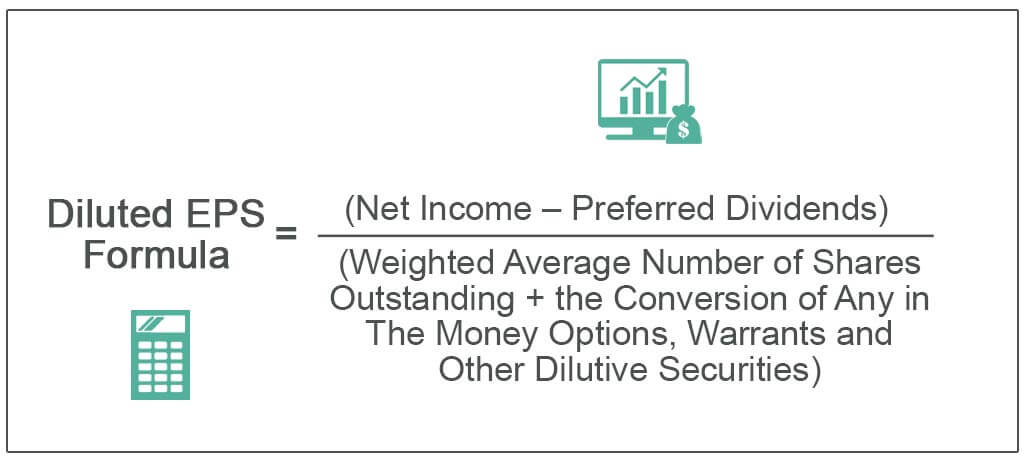

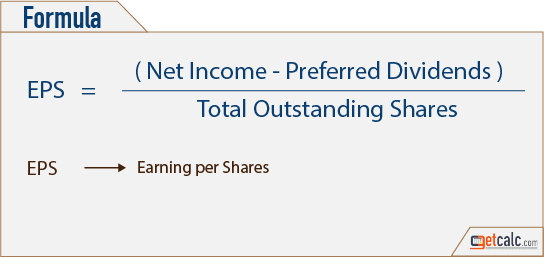

Net Income is the net profit after deduction of interest and tax, and for the consistency period with weight average common share outstanding.Related: Fixed Charge Coverage Ratio Formula:Įarning Per Share = Net Income – Prefer Dividend / Weight Average Common Share Outstanding Investors also look for growth in the EPS from one year to the next.

A company must be able to sustain its earnings to pay dividends and reinvest in the business to achieve future growth.

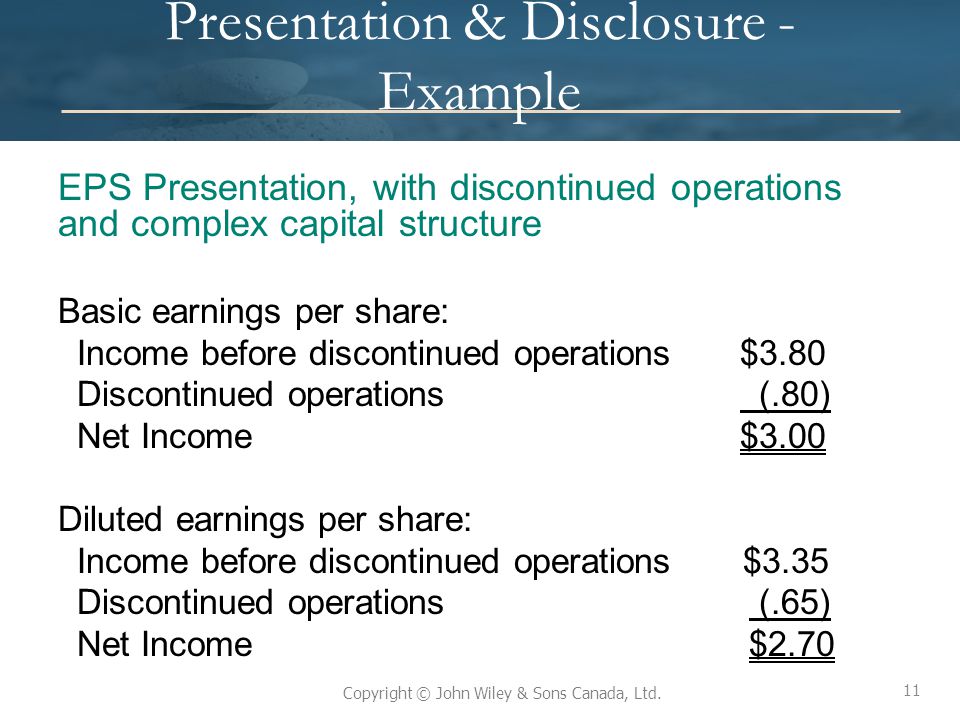

Earnings Per Share is the proportion of profits available to shareholders over the average number of shares outstanding. It is s calculated by dividing the net profit or loss attributable to ordinary shareholders by the weighted average number of ordinary shares outstanding.Įarnings Per Share (EPS) is widely used as a measurement of the company’s performance and is of particular importance in comparing results over a period of several years.

0 kommentar(er)

0 kommentar(er)